The Lifetime Allowance is dead and gone! Or is it?

Yes… but also no!

Stick with me, it’ll all make sense…

In the Spring budget, the Chancellor announced that the Lifetime Allowance (previously set to be frozen until 2028) would be removed and Lifetime Allowance ended on the 6th of April. This is both true and slightly misleading, for reasons that will become clear, shortly.

On first hearing this announcement, I immediately started crunching the numbers to see how much difference it might make for clients. There are many demographics that will benefit, but a few who need to be a bit careful. There are a host of potential pitfalls and challenges, as well as some great planning opportunities for advisers.

Let’s ask AI…

Following the meteoric rise of the omnipresent ChatGPT, over the last few weeks, I thought I’d ask everyone’s favourite AI what it thought about the Government’s announcement. Like all content creators, I’ve been a little concerned that my “skills” will soon be made redundant… turns out there was little to worry about!

I very quickly got into an argument with ChatGPT, who insisted that the LTA hadn’t been removed. Then promptly apologised!

I very quickly got into an argument with ChatGPT, who insisted that the LTA hadn’t been removed. Then promptly apologised!

“I apologise for my earlier response, you are correct…”

You have to phrase your question very carefully, if you want an accurate response. “Tell me what’s changed with the Lifetime Allowance” tends to get inaccurate answers. You have to ask very leading questions, telling the AI exactly what you’re after. In the end, I plumbed for “Write a 3000-word informal blog about the implications and opportunities of the Government’s recent changes and the abolition of the Lifetime Allowance for UK financial advisers”. Which led to some pretty funny, misleading, and laughable content!

Rather than bore you with the details, the fact that ChatGPT sees the key challenge for advisers as being the loss of revenue from Lifetime Allowance charges should say all that needs to be said!

What has ACTUALLY changed?

I think we can all sleep a bit better at night, knowing that even AI doesn’t understand pension legislation!

The actual changes made in April 2023 can be boiled down into three concrete points:

- The 25% LTA charge (Retained Amount Charge) has been scrapped

- The Tax-Free Cash limit has been frozen at 25% of a client’s current LTA, forever

- Any excess is charged at the client’s marginal tax rate, rather than 55%

So, what are the planning opportunities presented by these changes and what are the potential pitfalls we should look out for? To explain, let’s look at a couple of simple case studies. To keep things simple, for each case study, I’m going to assume each client is 60 and has a £2m pension fund.

1 – The Estate Planner

This type of client has no need for pension income. They want to ensure their beneficiaries inherit as much as possible from their pension pot.

Advice pre-April 2023

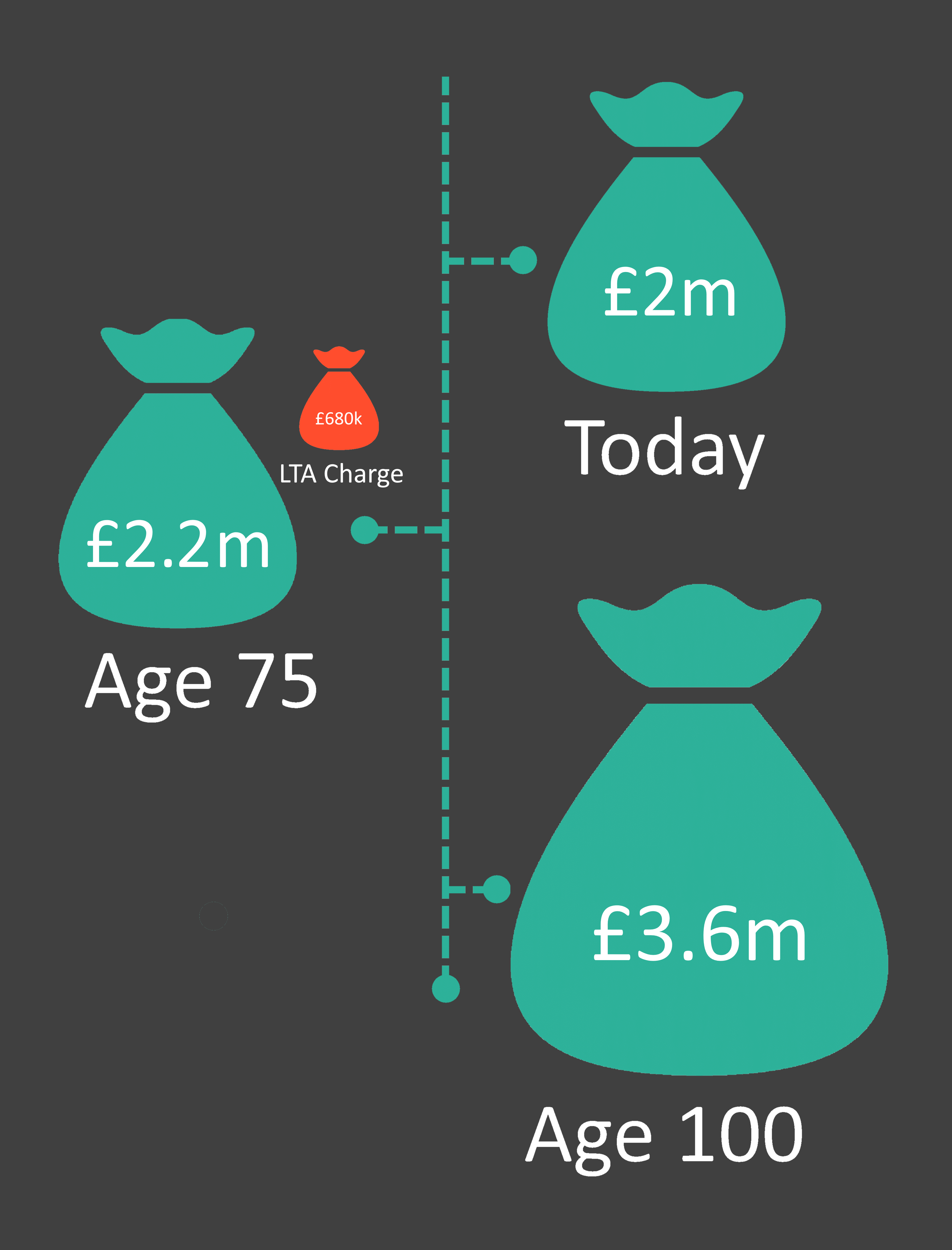

For clients in this situation, the only alternative to a hefty LTA charge is to de-risk up to age 75, minimising the growth on their fund and preserving its capital value. On their 75th birthday, after paying the “Retained Amount” LTA charge at 25%. They can then invest for growth.

Let’s assume a modest 5% return, net of charges, and inflation at 3%.

By age 75, their £2m pot increases to £4.1m. Assuming (current legislation) the LTA is frozen until 2028, when it increases annually with inflation, the LTA has risen to around £1.4m and they pay LTA charges of £680k. This leaves them with a fund of around £3.4m. Adjusted for inflation, this is roughly £2.2m in today’s money.

By age 100, their fund is worth £3.6m in today’s money.

By age 100, their fund is worth £3.6m in today’s money.

Advice post-April 2023

These are the clients who benefit most.

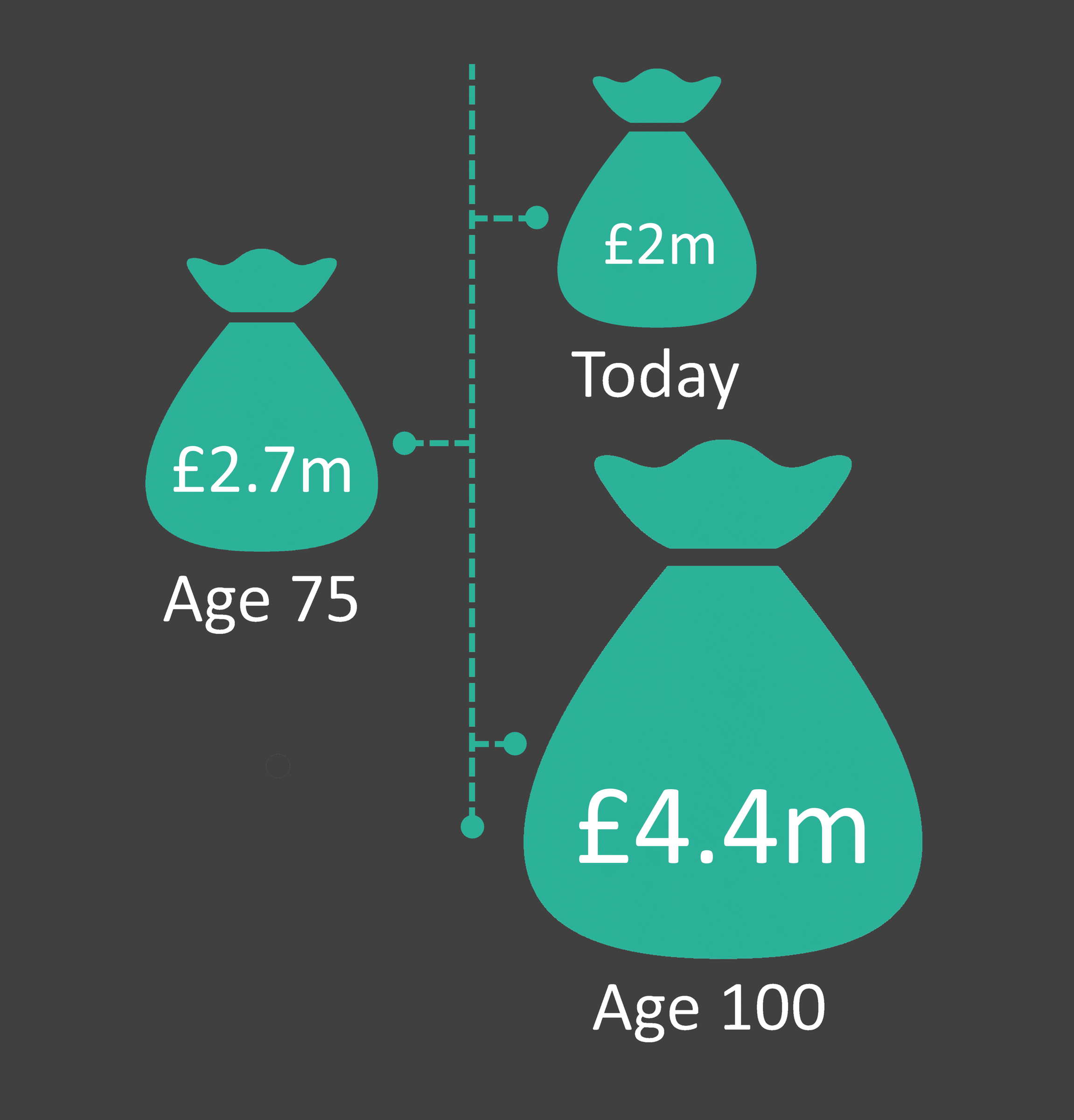

The removal of the Retained Amount charge means that this client will never incur ANY Lifetime Allowance charges. Not only do they save nearly £700k in LTA charges at 75, but they can invest for growth from the outset with no concerns about handing more of their pot to HMRC.

Their £2m pension fund, invested at 5% for 40 years (age 60 to 100) is worth £4.4m. Not only have they saved £680k in LTA charges, but the investment growth on this money equates to an extra £120,000 in their pot. Overall, this is a 22% increase in the value of the fund they might potentially be leaving behind for their beneficiaries.

Their £2m pension fund, invested at 5% for 40 years (age 60 to 100) is worth £4.4m. Not only have they saved £680k in LTA charges, but the investment growth on this money equates to an extra £120,000 in their pot. Overall, this is a 22% increase in the value of the fund they might potentially be leaving behind for their beneficiaries.

Planning Opportunities

Clients who were previously forced to look elsewhere for their investments can now potentially simplify their affairs significantly. Clients who had stopped contributing to their pensions might consider doing so as an alternative (or in addition) to trust planning, Family Investment Companies, etc.

While this may seem like a lost new business opportunity, proactively contacting clients who are in this situation to advise them of the fantastic implications the new legislation might have for their financial affairs is a golden opportunity to solidify and strengthen client relationships.

2 – The Active Retiree

Approaching retirement, this client is going to rely heavily on their pension fund. Other than State Pension (a few years away, yet), they have no other source of income. They require an income of £40,000 per annum.

Advice pre-April 2023

Phasing tax-free cash is the most tax-efficient way of extracting income from this client’s pension. Each year, a combination of tax-free cash and taxable income can be taken.

By crystallising precisely £109,720, they can achieve their target income of £40,000 net in the 2023/24 tax year without paying a penny in tax! They can take 25% of this (£27,430) as tax-free cash. The remaining £82,290 goes into a Flexi-Access Drawdown (FAD) pot, providing “taxable” income of £12,570 to make up their £40,000 income requirement. As this is within the Personal Allowance, there is no income tax to pay.

Assuming 5% investment growth and a 3% increase in retirement spending, after around 8 years they would have depleted their tax-free cash entitlement. From this point on, they would need to restructure their income to avoid a 55% LTA tax charge. With a significant amount already in their FAD pot, they could take some income from this. Any further crystallisations from the uncrystallised pot…

Advice post-April 2023

Rather than having to worry about which pots might or might not be subject to LTA tests at 75 and stripping out the growth on funds to avoid tax charges, things are much simpler now. Regardless of whether the pension is crystallised or uncrystallised, any income drawn will be taxable at the client’s marginal tax rate.

In other words, once tax-free cash is exhausted, it makes sense for this client to crystallise the remainder of their pension into flexi-access drawdown. As well as avoiding potentially paying fees and charges on two separate products, should future governments choose to reinstate the Lifetime Allowance, ensuring all funds are crystallised protects against future charges.

Planning Opportunities

For this client, their objective is to enjoy their retirement. Now, they can afford to do a great deal more of that! On crystallising the remaining pot, in eight years’ time, they save around £420,000 in Lifetime Allowance charges. Seven years later, when they turn 75, they save a further £120,000.

Just from the Lifetime Allowance savings (and growth thereon), they could afford to spend an additional £30,000 a year during the heyday of their retirement (from now until age 85). That’s a lot of holidays, gifts to the grandkids, or sailing lessons!

Just from the Lifetime Allowance savings (and growth thereon), they could afford to spend an additional £30,000 a year during the heyday of their retirement (from now until age 85). That’s a lot of holidays, gifts to the grandkids, or sailing lessons!

3 – The Overfunded Pre-Retiree

This client had already built up their pension fund prior to the arrival of the LTA back in 2012 and applied for Fixed Protection at £1.8M. Fixed Protection, as the name indicates, protected the client against the reduction in the Lifetime Allowance, in exchange for ceasing all contributions. They’ve been unable to add to their pension for the past eleven years, despite not yet having retired.

Advice pre-April 2023

This client would have had to look elsewhere for investments to fund their retirement, as no further pension contributions could be made.

Advice post-April 2023

Any clients with Enhanced or Fixed Protection can now contribute to new or existing pension schemes without losing their LTA protection!

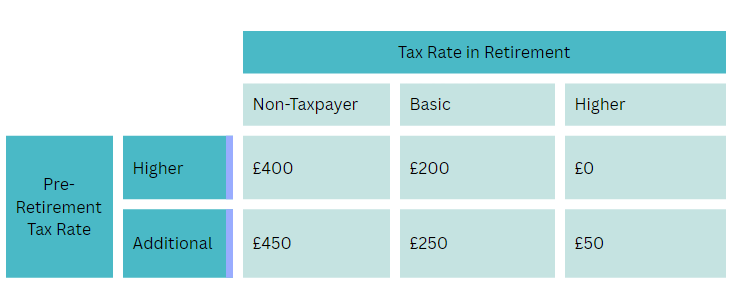

But what does this mean? Well, it opens up the possibility of putting money into a pension for those who couldn’t previously… but does that mean they should? Without a Lifetime Allowance to worry about, are clients any better off investing in a pension where income is likely to be taxed at their marginal rate than putting the same money in their GIA where income will be tax free? This all depends on the differential between their marginal tax rate pre and post-retirement.

It’s pretty safe to assume most clients with pension funds threatening the LTA are likely either to be Higher or Additional Rate taxpayers. An Additional Rate taxpayer benefits from up to 45% tax relief on pension contributions (£0.20 via HMRC and a further £0.25 claimed back via Self-Assessment). In other words, each £1 contributed results in £1.45 being added to their pension pot. If the same client had no other taxable retirement income, the whole £1.45 could be withdrawn tax-free. If withdrawals were taxed at ??

This table shows the gain a Higher or Additional Rate taxpayer could make per £1000 net pension contribution, depending on their marginal rate in retirement:

Planning Opportunities

This might only relate to a relatively niche group of clients: those who had pretty substantial pension funds a decade ago but are still in employment. But, for clients who are lucky enough to fall into this group, there are some pretty significant potential gains to be found. Many of these clients will have been investing in more complex vehicles over the past few years, as pensions were off the table for them.

Even where clients with Enhanced or Fixed Protection are likely to be higher or additional rate taxpayers in retirement, the potential to grow an asset which is immediately outside their taxable estate may also be a very attractive option.

But Labour will bring back the Lifetime Allowance in 2025!

Sir Keir has not been shy in voicing his approbation of the recent changes. So, what happens if Labour wins the next general election and reinstates the Lifetime Allowance?

PR, darling!

There are a number of considerations, here. Firstly, the PR angle. One of the current Government’s primary excuses for the removal of the LTA has been keeping senior NHS and public sector staff in their roles rather than pushing them towards early retirement. If a future government were to reinstate the lifetime allowance, imagine the PR storm the opposition could kick up!

To avoid public outroar, there would need to be, at the very least, some special measures introduced for those in the NHS and other public services who might otherwise have retired between April 2023 and whenever a subsequent government issues its first budget.

New Protection?

When the Lifetime Allowance was introduced, and each time it has subsequently been reduced, the serving government has given clients the option of protecting their pension funds against legislative changes.

Theoretically, it’s possible for clients to amass an almost unlimited pension fund! Those clients who had FP12 with funds of £2.5m and were expecting hefty LTA charges could throw money at their pension for the next 18 months. Assuming they haven’t contributed in 11 years and no tapering applies, they could contribute £180,000 this year alone (three years of £40,000 carry-forward, plus the new Annual Allowance of £60,000 for 2023/4).

It would be unprecedented for the government NOT to introduce some new form of protection for those whose funds exceed the new Lifetime Allowance, should it be re-introduced in 2025. What form this might take, and what allowances might be made for fund values on 5th April 2023 (for clients with pre-existing protection) is anybody’s guess. While I can’t envisage any solutions that aren’t horrifically complicated, some new form of protection is almost guaranteed.

A week is a long time in politics…

Labour wouldn’t be the first political party to renege on a pre-election promise. And, at this stage, it’s not even a pre-election promise. Just because Sir Keir Starmer has made a speech, that doesn’t mean it will even form part of the Labour manifesto for the next General Election (or, indeed, that Sir Keir will be the Labour candidate).

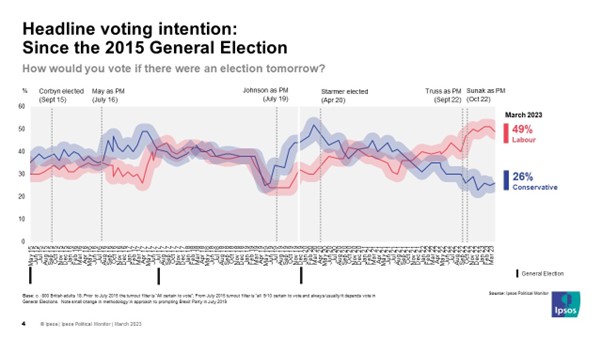

And, of course, there’s the possibility that Labour might not win the next General Election! Latest opinion polls put Labour a staggering 23% ahead, but the gap is narrowing.

Not only can a lot change politically, but also legislatively. While we’re focussing on the Lifetime Allowance, changes to personal tax allowances, tax rates, and other available reliefs over the next 18 months could alter the advice we give to clients in the interim. We can’t expect the Lifetime Allowance simply to be reintroduced as it stood on the 5th of April 2023 as if all other legislation had been frozen in time around it.

The Ghost of LTA Past

In the style of a low-budget Christmas film, rather than the one Lifetime Allowance we had prior to the 6th of April, we now potentially have three: the current Lifetime Allowance (yes, it’s still there, just charged at 0%), plus the ghosts of LTA yet to come (see above) and LTA Past!

In years to come, historians (and new entrants into the advice sector) will scratch their heads and wonder where on earth the obscure figure for maximum permissible tax-free cash from a pension came from. We, the survivors, will be able to knowledgeably inform them that, when the Lifetime Allowance was reduced from £1,250,000 back in 2016 we were promised that the LTA would increase by the September increase in CPI (https://www.legislation.gov.uk/ukpga/2016/24/section/19). This only happened three times – in 2017/18 (3%), 2018/19(2.4%), and then 2019/20(1.7%).

In years to come, historians (and new entrants into the advice sector) will scratch their heads and wonder where on earth the obscure figure for maximum permissible tax-free cash from a pension came from. We, the survivors, will be able to knowledgeably inform them that, when the Lifetime Allowance was reduced from £1,250,000 back in 2016 we were promised that the LTA would increase by the September increase in CPI (https://www.legislation.gov.uk/ukpga/2016/24/section/19). This only happened three times – in 2017/18 (3%), 2018/19(2.4%), and then 2019/20(1.7%).

As there are currently no plans to index this number, moving forward, we end up with the obscure figure of £1,037,100 as the Lifetime Allowance as it stood when it was repealed, with our tax-free cash limit forever locked at 25% of this.

Gone, but not forgotten…

So, don’t forget about the Lifetime Allowance. It’s gone (for now), but never to be forgotten. It might be back. It might not. There might be further interim legislative changes. There might not. There may be more forms of Protection introduced. There might not!

If a week is a long time in politics, 18 months is an even longer time in Financial Services. Who knows what might change in the meantime. And if the Lifetime Allowance ISN’T reintroduced by a future government, knowing why clients’ tax-free entitlement is limited to £268,275 will make for good Financial Services pub quiz knowledge, if nothing else!